Category Archives: Uncategorized

How Did Home Sellers Handle Multiple Offers?

How Did Home Sellers Handle Multiple Offers?

If you or someone you know is thinking of selling please feel free to contact me.

The Cost of Waiting to Buy a Home Until 2015

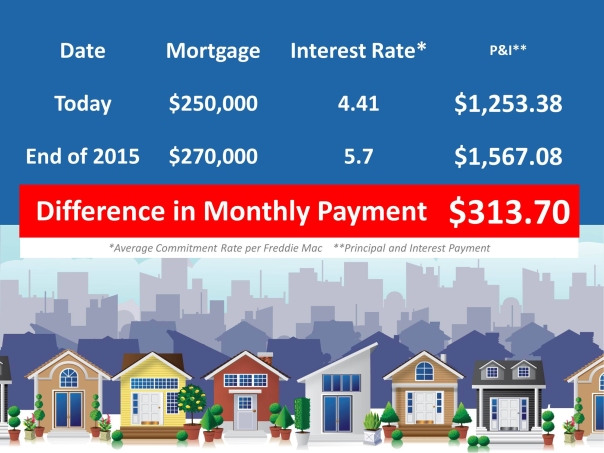

The cost of waiting to buy a home is increasing everywhere. In just 2013 alone, the cost of purchasing a home increased roughly 25% for buyers, as home prices surged between 12%-20% in most markets and mortgage rates also increased from 3.25% to 4.5%, which resulted in a 13% increase in mortgage payments. So a buyer who was approved at $500k at the beginning of 2013, can now only afford $435k using the same monthly payment today. Already in 2014, mortgage rates and home prices are continuing to increase, so what is the potemtial cost of waiting to buy a home until later this year or 2015?

1. The Potential Cost of Waiting to Buy a Home Until 2015

It is important that buyers consider rising interest rates and rising home prices when thinking about the true cost of a home. Remember, cost is not determined by price alone but by price and mortgage rate. The longer a buyer waits, the higher the mortgage payment will be if rates and home prices continue to increase.

For example, lets take a $250k home that a buyer can buy today with a 4.4% rate, the payment is $1,251 on a 30 year fixed loan.

But if home prices increase from $250k to $261,250 this time next year (which is only an annual increase of 4.5%), and rates increase to 5.3%, the monthly payment now increases to $1,450, a difference of $199 a month.

That means a buyer who waits a year to purchase a home, would pay an additional $71,578 in interest and payments over the life of the loan to purchase the same home.

2. Home Prices are Continuing to Rise Everywhere

Home Prices are on the rise everywhere, as limited inventory is driving prices up. It is the law of supply and demand at work, with limited supply demand will rise, and this is why we are still seeing bidding wars for properties in many local markets, and this in turn is driving prices up.

For example, check out the year-over-year home price appreciation gains for the cities Case-Shiller tracks for its report on housing values!

The housing markets in San Diego, LA and San Francisco have all seen annual appreciation gains of roughly 20% over the past year.

3. The Cost of a Mortgage Increased 13% in 2013

It has been a rough ride for mortgage rates over the past 15 months. As you can see on this chart below, 30-year fixed mortgage rates increased from 3.25% to 4.5% during 2013.

A buyer who would afford $500k at the beginning of 2013, can now only afford $435k using the same monthly payment today. So in just 15 months, the cost of paying a mortgage has climbed 13%, and a buyer has lost 13% in purchasing power.

Most experts are predicting interest rates to end 2014 higher than 5%.

4. As Mortgage Rates Increase in 2014, Your Purchasing Power Will Fall

A question that many buyers have is, “if rates continue to rise how will this affect my affordability?”

Here is a good chart that all buyers should review, that shows the “impact of rising rates on a buyers purchasing power or affordability”.

It shows if rates just increase by 1%, from 4.5% to 5.5%, a buyer will lose another 10.75% in purchasing power, which means, if they can afford to purchase $600k today, they will only be able to afford $540k in a year!

Add in another 8%-10% home appreciation, and the cost of a home could potentially increase another 15%-20% over the next year.

5. Buy A Home When the Fed is Offering Money at a Discount.

Another question many buyers ask is, “When is a good time to buy a home?”

I think a great time to buy a home is when the Federal reserve is pumping monetary stimulus into the economy, via their Quantitative Easing or “QE” program. This is artificially supressing interest rates and giving buyers the opportunity to borrow money at a discount.

But now that recent economic data has been improving, the Fed has already started pulling back on their Quantitative Easing program, which in turn is automatically increasing rates and the cost to borrow money to purchase a home.

As you can see on this chart below, the influence of Federal Reserve stimulus on mortgage rates is undoubted, and is the #1 reason why rates are so low in the first place. The average 30 year fixed rate prior to stimulus was roughly 6.5%, compared to today’s rates of roughly 4.5%.

This is a chart that all buyers and move-up-sellers who are contemplating when they should sell should review, so they know what effect the Fed is having on current interest rates and affordability. Without Fed stimulus, rates will eventually revert back to normal, which will be roughly 6.5% on a 30 year fixed.

6. Putting Current Rates in Perspective!

Here is a good chart that all buyers should review. The all-time record low in rates – since Freddie Mac began tracking mortgage rates in 1971 – was 3.25% in November 2012.

Conversely, the all-time record high occurred in October of 1981, hitting 18.63%. That’s more than four times higher than today’s average 30-year fixed rate of 4.32% as of March 20.

So rates hovering around 4.5% today may be high relative to last year, but buyers should still feel lucky they are getting this rate compared to almost any year since 1971.

Please call me if your ready to start the home buying process, Anita Downs Realtor 909-910-9491. I also give valuable Real Estate Information on my facebook business page http://www.facebook.com/soldbyanita

#chino#chinohills#realestate#searching for a home#diamondbar#phillipsranch

Now is a great time to list your home for sale.

Prices continue to rise and with interest still at historically low rates there are lots of buyers driving the prices up. If you want a free evaluation of your home don’t hesitate to contact me.